There are funds with huge AUMs that continue to perform well despite their size. The fund has the majority of its money invested in Financial, Technology, Services, Automobile, Energy sectors. It has taken less exposure in Financial, Technology sectors compared to other funds in the category. Axis Bluechip Fund Direct Plan-Growth scheme’s ability to deliver returns consistently is in-line with most funds of its category.

The performance of the Axis fund is majorly due to lesser holding, only 33 securities. In which they have focused more on the stocks which will be leading the Index. In the last 7 years which is from the time of inception. Axis fund, ICICI fund, and NIFTY 50 have shown an annualized return of 14.18%, 12.17%, and 8.45% respectively. The total holding of Axis and ICICI funds are 33 and 70 securities respectively.

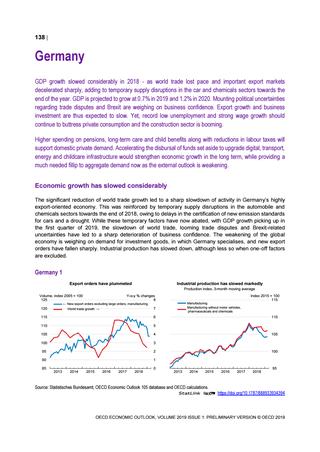

SIP Returns

If you have started a SIP online, cancel SIP option is available for upcoming transactions. In case you have started a SIP by visiting a branch, you will have to visit the branch or connect with a relationship manager to have the SIP cancelled. BFL is also registered with the Association of Mutual Funds in India (“AMFI”) as a distributor of third party Mutual Funds (shortly referred as ‘Mutual Funds’).

SIP – Systematic Investment Plan is a disciplined way of investing wherein a fixed amount of money is invested in a pre-defined mutual fund scheme at a fixed interval. You decide the amount, the SIP date and the schemes in which you wish to invest. One can plan different life goals be it such as children’s future, retirement, international holiday, holiday home, etc. Systematic Investment Plan allows you to make small investment at regular intervals to help you achieve your dreams. Axis Bank offers its customers a choice to start a SIP in mutual fund schemes of 20 Asset Management companies .

Limited Period Offers

A percentage of your capital gains payable to the government upon exiting your mutual fund investments. Taxation is categorized as long-term capital gains and short-term capital gains depending on your holding period and the type of fund. A mutual fund primarily invests in stocks is known as an equity fund.

After 1 year, you are required to pay LTCG tax of 10% on returns of Rs 1 lakh+ in a financial year. All comparisons are done with the category average metrics for this category. You can start small and there is no need to have a lot of money to start a SIP. A SIP of even Rs. 500 per month is sufficient to start with. And then depending on the goals and aspirations, one can increase the amount. It is a statistical tool that measures the deviation or dispersion of the data from the mean or average.

Why is Axis Blue Chip fund not doing well?

This fund is managed with a growth-oriented approach, and post Covid, growth style of investing has been out of favour. This resulted in the fund delivering a rather underwhelming performance in 2021 and this year so far.

Riskometer stipulated by SEBI reflects the current risk of the scheme at a given point of time. Hereunder are applicable charges and tax obligations that may apply to you. Make sure you understand these well before you decide to invest. If the units are sold within 1 year, then the gains are treated as Short Term Capital Gains and are taxed at the rate of 15%. Both these funds have shown a higher return than the Nifty 50 Index.

Our Companies

People perceive that SIP is either a mutual fund or different than a mutual fund. However, the fact is that SIP is a style of investment and not a fund/scheme or a stock or an investment avenue. It is a vehicle to invest periodically in a fund/scheme of your choice. It is an indicator of how quickly fund managers buy and sell the specific assets and securities within the fund in a specified period.

A fund with a higher Sharpe ratio is considered better than a fund with a lower Sharpe ratio. Sortino ratio is the statistical tool that measures the performance of the investment relative to the downward deviation. It is an unmanaged group of securities which are considered as a ‘benchmark’ to measure a fund’s/stock’s performance.

What is the 5 year return of Axis Bluechip?

1. Current NAV: The Current Net Asset Value of the Axis Bluechip Fund as of Mar 24, 2023 is Rs 40.71 for Growth option of its Regular plan. 2. Returns: Its trailing returns over different time periods are: -7.13% (1yr), 15.88% (3yr), 10.78% (5yr) and 11.25% (since launch).

The sharpe ratio is a measure of an investment’s return after taking into consideration all the inherent risks. Alpha is the excess returns relative to market benchmark for a given amount of risk taken by the scheme. For each mutual fund, the risk can range from low to very high, as depicted by different colours in the riskometer. The meter categorizes the schemes under different levels of risk based on the respective scheme’s asset allocation pattern. To help you make informed investment decision, here is a list of other fund options in the same category with similar returns. It is the smallest value amount for which an investor can purchase a mutual fund.

However, the investor is never sure of market direction. This fund is best suited to the investors who have long-term investment goals and can stay invested for 3-5 years. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. The AUM of the fund is a good indicator of its popularity. A fund with a high AUM means a lot of money has been invested in it, and investors like it. However, the AUM should never be the primary criteria while selecting a fund.

Savings Account

The axis bluechip fund growth SIP investment is the best alternative that can be opted by an investor in order to gain high growth of capital in the long run. Hereunder is mentioned an overview of nav of axis equity fund g scheme that would assist you in deciding whether or not you should opt for the same for your portfolio. 96.4 percent of the funds are put in stocks and shares while the remaining 4.8 percent are invested in the debt instruments. The average market capitalisation of the scheme is Rs.76,384.35 crore as against Rs.45,171.91 crore of its category. This shows the overall market possession by the axis bluechip growth fund scheme.

The Expense Ratio is a percentage of Assets Under Management and is taken from the returns generated by the fund. For this reason, a fund with a lower expense ratio is always better because a smaller part of the returns will be taken and that means more returns for you. Before investing in a mutual fund, it is important to analyse its performance based on certain parameters.

Mutual Funds Screener

For Dividend Distribution Tax, the dividend income from this fund will get added to the income of an investor and taxed according to his/her respective tax slabs. Alpha shows the ability of the fund manager to outperform the market. Returns are taxed at 15%, if you redeem before one year.

For someone whose investment objective is long-term wealth creation and who has a very high risk appetite can choose multicap fund. A mutual fund scheme is not a deposit product and is not an obligation of, or guaranteed, or insured by the mutual fund or its Asset Management Company . Due to the nature of the underlying investments, the returns or the potential returns of a mutual fund product cannot be guaranteed. Historical performance, when presented, is purely for reference purposes and is not a guarantee of future results. A. The current expense ratio for Axis Bluechip Fund Regular Growth scheme, as on 26th September 2022, is 1.62 percent.

Compares the scheme’s return versus the benchmark index. You’ll find the end of day price of the Axis Bluechip Fund Growth fund for the selected range of dates. The data can be viewed in daily, weekly or monthly time intervals.

Axis Bluechip Fund is suitable for investors with moderate to high-risk appetite looking to invest for a period of 5 years & above. But, it is up to investors to choose any funds which have performed over the index. Axis bluechip fund has a low expense ratio compared to ICICI blue chip fund. The fund has comparatively the same volatility when compared to the Nifty 50 Index and category average. The fund has low volatility when compared to the Nifty 50 Index and the category average.

There are some goals you’re able to fulfil and others that you’re not. Provide few more details needed including the bank account from which you will be making axis bluechip fund graph the payment and confirm. The fund’s top 5 holdings are in ICICI Bank Ltd., HDFC Bank Ltd., Bajaj Finance Ltd., Infosys Ltd., Avenue Supermarts Ltd..

- The fund has the majority of its money invested in Financial, Technology, Services, Automobile, Energy sectors.

- Highlights the recent performance in the last few years.

- It is necessary to analyze both the reward and risk of the fund before investing.

- SIP instills discipline as it is route which helps you invest a particular amount on a regular basis.

The lesser in number compared to Index and category average is termed to have low volatility. In the case of Axis bluechip, even though the P/E is higher, the holdings share is completely dependent on the main 10 stocks which carry the growth of the Index. That is the reason, the fund will still tend to grow even after any crash. This fund will outperform the index in long run between 10 years and 15 years of performance.

Is Axis Bluechip fund good?

Over the past 10 years, Axis Bluechip has been the third-best performing fund among its peers and has delivered a CAGR of over 15%. The average returns of all funds are around 13% for the same period. If we compare year-on-year performance with its category, the fund has delivered outperformance in most of the years.